Customer experience is a top priority for businesses, especially now that most of our transactions are virtual.

For 2021, 86% of the buyers are willing to pay more for a superior customer experience, making it a key differentiator, surpassing price and product value.[*]

If you already provide customer service, convenient payment options, amazing products, etc. What else can you do to improve the customer experience?

The answer is Customer Lifetime Value or CLV.

Before e-commerce, not all marketers and businessmen understand CLV. And even during the kick-off of e-commerce, CLV is still a hazy topic, with only 34% of the marketers fully aware of its meaning and significance.[*]

This article will help you understand CLV and how it plays a big role in improving customer experience.

What is CLV?

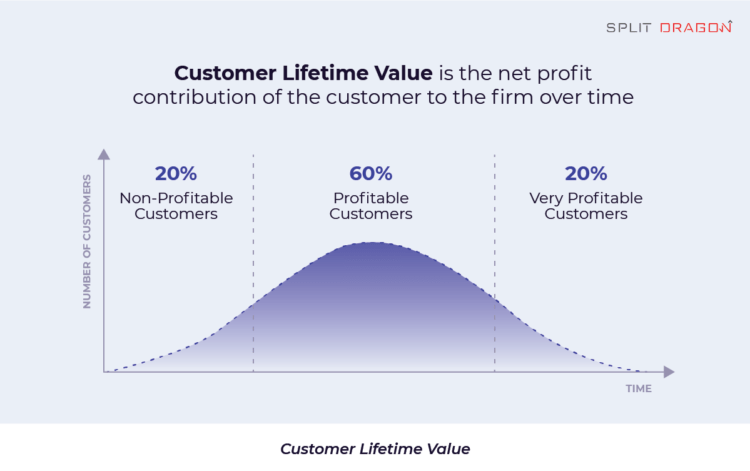

CLV or Customer Lifetime Value is a prediction model that measures the expected revenue a business can sensibly get from a customer throughout their business relationship.

A basic example would be:

Every year on your father’s birthday, you send the same $80 cake. You have been doing this for the past 3 years. So now, your lifetime value for the cake shop would be $240.

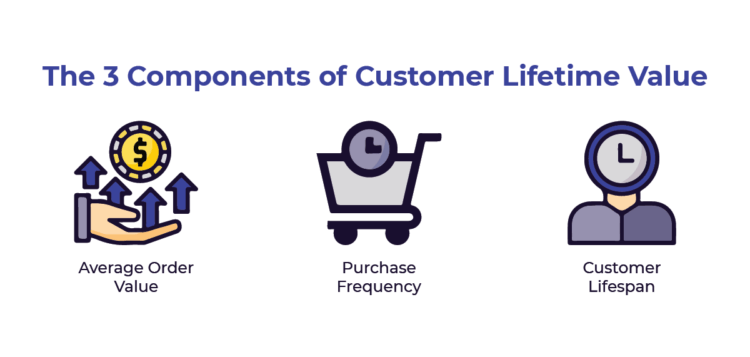

Essentially, CLV is a product of three components:

- Average Order Value

- Purchase Frequency

- Customer Life Span

Traditionally, businesses and marketers use CLV to segment their customers so they can come up with tailored engagement strategies.

But as businesses evolve with the help of technology, data and information are more accessible. Now, businesses are reorganizing CLV around the customer journey, and not just looking at the touchpoints.

They also dive into customer behavior that impacts changes of CLV across the customers’ entire journey with the business.

This means that CLV is more useful and effective for long-term marketing planning.

Advantages of CLV

In a competitive industry like e-commerce, a seamless transaction will put you on top of your competitors. This is where you can use CLV. Here’s where you can use your CLV insight:

Foster Retention and Loyalty

Any business desires clients with high lifetime value as this translates to brand loyalty. They ensure steady returns and secure your business presence in years, and even decades to come. In fact, 61% of loyal customers will make an extra effort just to purchase from their favorite products (or brands) and services.[*]

For long-term revenue, CLV will help you track customers’ purchases and optimize. You will see and understand what each customer needs in every step of the buying process.

Takeaway: Customer loyalty is the result of positive customer experiences. CLV helps you to understand the full customer journey by diving into each customer and seeing where and why customers churn or retain.

Informs Customer Acquisition Cost

Customer acquisition cost or CAC is the price value you spend on acquiring a new customer. And acquiring a new customer is more expensive than retaining one.

But with CLV, you can avoid spending more than what your new customers can bring in.

Also, using CLV will help you figure out how much you can spend on acquisition without sacrificing your profit margin.

Improve Marketing Strategy

Now that you have a well-defined prospect and you know the buying capacity of your existing customers, you can build campaigns around their interests. Keep your customers informed and engaged by offering valuable content, either through email marketing, social media or blogging.

Also, with CLV, you can pinpoint the pain points of customers, thus you can effectively market the positive impact of your product or service instead of just pitching its features.

Discover and Invest in Profitable Customers

Knowing what your ideal customers are, you can tailor your offerings that will match their needs. You can create targeted campaigns and produce ads that will capture your most profitable demographic.

The CLV insight also allows you to see which customers are money losers, so either you create a strategy to transform them into profitable buyers or make a way to remove them from the business altogether.

How to Calculate Customer Lifetime Value?

When you are talking about lifetime value, you are looking at the entire customer journey with your business. This includes the how’s, why’s, who, and when.

As mentioned earlier, you are looking at their average order value (per customer) purchase frequency, and customer lifespan.

To calculate CLV, you need to calculate first the customer value by multiplying the average purchase value by the average number of purchases.

Customer value = average purchase value x average number of purchases

After identifying the customer value, multiply it by the average customer lifespan, and you will get the CLV.

Of course, you have to take into consideration the behavior patterns, purchasing patterns, and engagement, allowing you to add functions to get accurate results.

Types of CLV Calculations

There are two types of approach you can use:

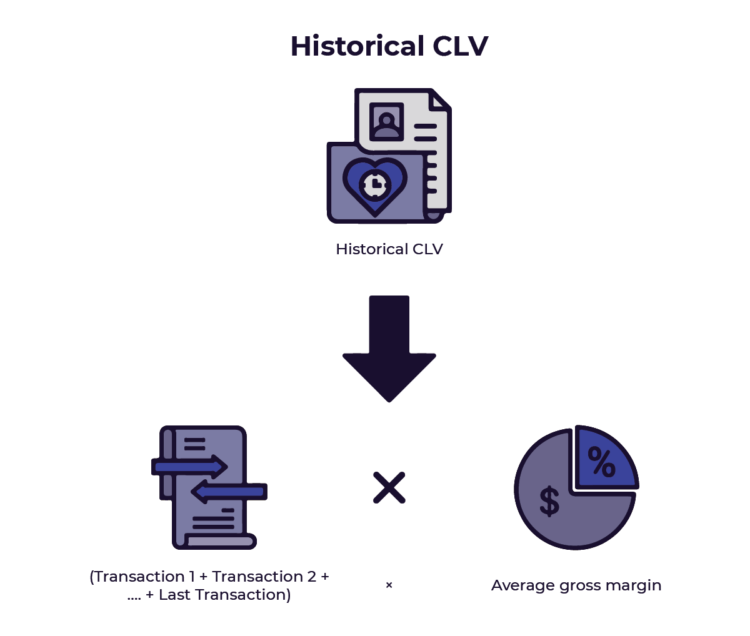

Historical CLV

This backward approach computes all the accumulated historical purchases of the customer. It shows the actual profit a customer is bringing to your business based on previous purchases.

Before calculating, you need to:

- Identify which factor your customer creates value;

- Measure your revenue at each factor

- Integrate all the data and create a customer journey

- Add all the accumulated transactions

Historical CLV = (Transaction 1 + Transaction 2 + …. + Last Transaction) x Average gross margin

The formula looks simple, however, if you want to get your figures up to date and accurate, you will have to calculate on an individual level.

Another disadvantage of Historical CLV is that it focuses solely on the sum of previous profit and fails to consider the actual value of new clients.

Predictive CLV

Predictive CLV influences both historical behaviors and forecasted retention, allowing marketers to gain various helpful insights.

This answers the questions:

- Which type of new customers will give you more profit?

- Where does your business earn the highest returns?

- What are the key attributes of a customer that drives customer retention?

This method allows marketers to formulate a specific model that can predict CLV for both new or recent clients, based on their buying patterns.

To accurately use predictive CLV, you will need:

- To know the factors where the client provides value

- Find out what establishes the value and how it differs from different customer and segment

- Determine the reason why a customer changes its buying behavior

Due to fluctuations in price (discounts, promos), determining exact predictive CLV can be complex. That is why there are two ways to compute the predictive CLV.

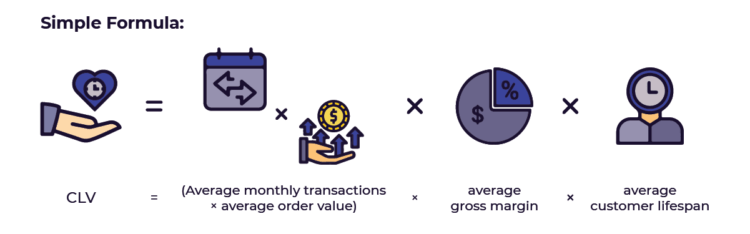

Simple formula:

CLV = (Average monthly transactions x average order value) x average gross margin) x average customer lifespan

This simple formula can be used if your customer’s annual profit is somewhat expected and consistent like subscription-based payment with only one to 2 tier options. But for complex factors such as retention rates, promos, etc. you can use the above formula as the gross margin contribution per customer value or GM and compute it as:

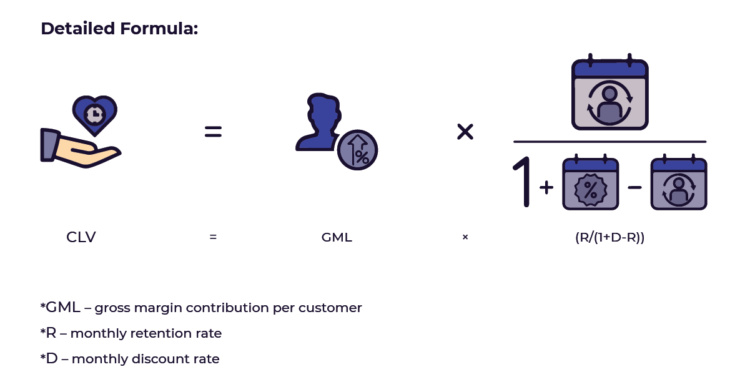

CLV = GML x (R/(1+D-R))

where

*GML is the gross margin contribution per customer

*R is the monthly retention rate

*D is the monthly discount rate

How to improve customer lifetime value for your eCommerce store?

Now that you’ve computed your CLV, it’s time to make it into actionable insight and generate more profit from your existing customers.

Here’s what you can do to improve customer lifetime value:

Create an exciting referral program

Perhaps the most low-cost way to increase CLV, a referral program is easy to set up in almost any type of business.

For your loyal customers who truly believe in your product or service, recommending your business to others is a no-brainer. And if you back up their word of mouth with rewards, you will not only gain new customers, your existing customers will also enjoy the perks of doing the marketing for you.

Use the best practices in the onboarding process

The first engagement with your customer is one of the crucial stages to achieve high CLV. It has to be smooth, seamless, clear, and satisfying. If customer satisfaction is met, 87% of them are more likely to purchase upgrades and additional services.[*]

It would be better if you will have a dedicated team that focuses solely on the onboarding process, and yes, they are not the sales team.

This team will be knowledgeable about the product, understand the pain points of the customer, and ultimately knows the whole onboarding procedure and how to assess the new customer in case they experience a bump while on the order process.

Offer superior customer service

More than 50% of the customers end up their relationship with the business due to bad customer service.[*]

Improving customer service includes valuing feedback, offering a personalized approach (this could also foster customer relationships), and paying attention at every touchpoint while having a full view of the customer’s experience.

You should be available and reachable by providing multi-channel support services like chat support, phone support, email, and even on social media.

Create an FAQ about ecommerce and your business

Using your CLV and by creating targeted content, your business can speak directly to each customer and give a quick answer to their pain points.

These contents include info graphs, high-quality and informative articles about you and your services, content that answers common pain points, video tutorials, and social media support (especially if you service Gen Z audiences).

Re-engage visitors and one-time customers

Remarketing strategies are one of the best ways to increase your CLV. It focuses on reaching those who interacted with your business but never became a repeating buyer or even a customer.

Create ecommerce exclusive perks or discounts to recover visitors and encourage re-engagement. Best examples and practices are:

- Incentives for reviews

- Offer special discounts to new buyers

- Send emails to past customers

- Offer live chat support

Promote cross- and up-selling

Cross-selling is when you invite customers to purchase related or complementary items while Up-selling is a practice that encourages the customer to purchase a higher value version of the product or service.

The best prospects for cross-selling and upselling are your existing customers. They already have experience and understanding about you and your product.

If done right, customers will accumulate more products and services over time, thus increasing CLV.

Summary

Nowadays, with countless options available in the market, price is not all that matters to most customers any more. It’s their journey and experience with you and your business that either can transform them into loyal customers or swerving visitors.

CLV is an incredible metric that can help you and your business provide a memorable experience to your customers.

Of course, your acquired insights will be nothing if you don’t act on them.

Over time, you will see what motivates your customers to purchase and why they become loyal customers. Apply this to your new customers and you will enjoy long-term business growth.